March 6, 2021

February 27, 2021

TAX (PLANNER) MATH

February 13, 2021

TAX (PLANNER) MATH

February 6, 2021

TAX (PLANNER) MATH

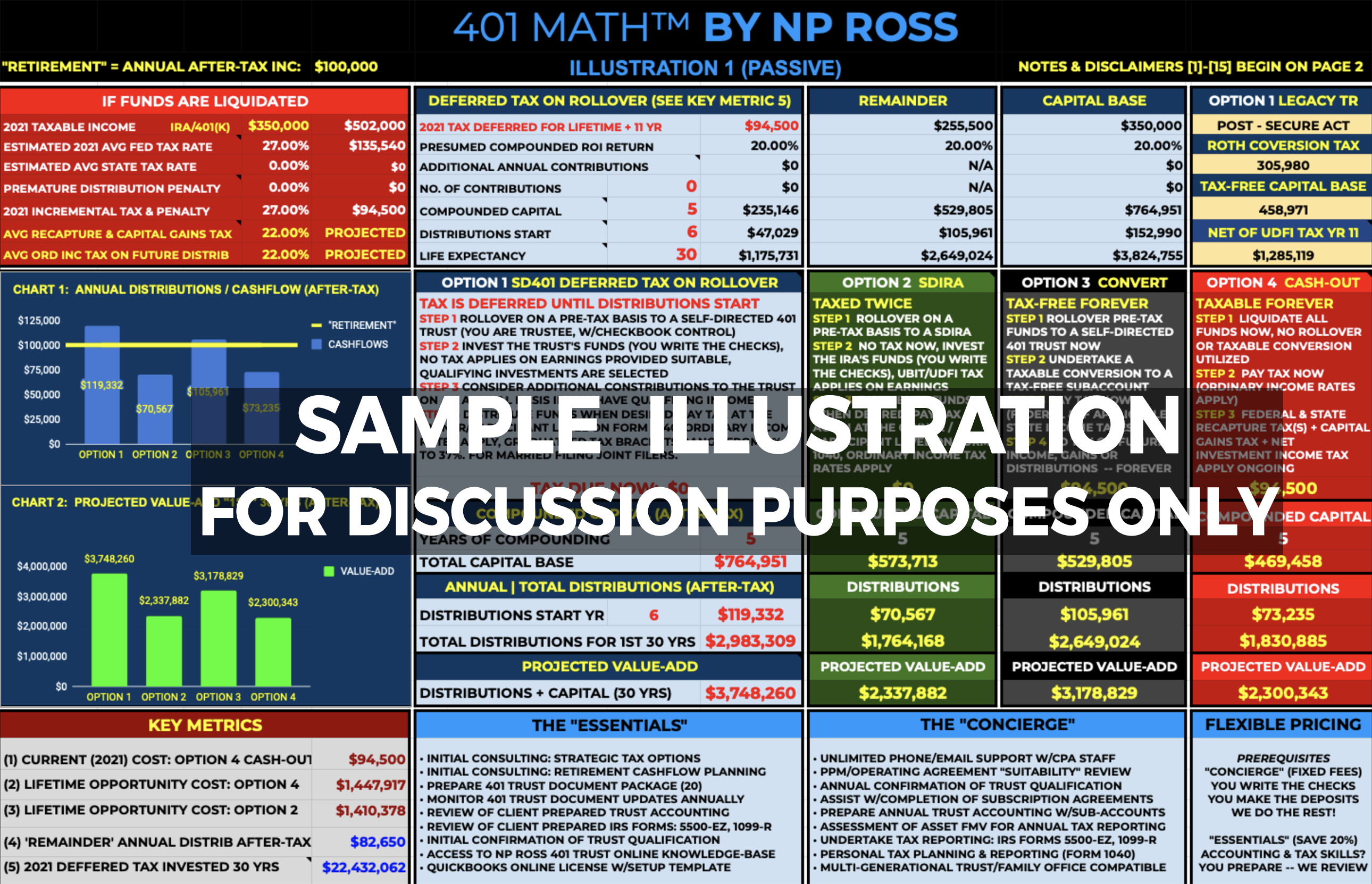

The Incredible Convertible 401 Trust: An Introduction

You are behind on saving for retirement, and seeking a way to turbocharge retirement savings. Most small business owners are unaware of the significant benefits of the self-directed 401 Trust. In this episode, host Nathan Ross CPA discusses the qualifications to establish a 401 Trust along with assorted reasons why it can be hugely beneficial for generating significantly more retirement […]

- « Previous Page

- 1

- …

- 8

- 9

- 10