Hello Planner

Investors leverage DEBT

They leverage their TIME

They leverage EDUCATION

Planners, leverage TAXES

Nathan Ross CPA, NP ROSS

A Planner accepts responsibility for maximizing their family's financial well-being.

They understand that tax savings can be leveraged to create more wealth for their family.

Less tax. More profit.

Get Started

Meet 401 Trust

"All I want in life is a small unfair advantage."

Hank Greenberg, AIG ex-CEO

TAX LEVERAGE?

Direct rollovers from an IRA or an Employer 401k to a 401 Trust are not taxed.

Qualified earnings of the Trust are taxed only when distributed.

As Trustee, you self-direct the Trust's investments and you control distributions.

A tax-leveraged 401 Trust can DOUBLE your retirement lifestyle.

Say 'Hello' to your own HUGE unfair advantage.

Less tax. More Profit.

Learn More

Explore REPPs

"We don't have to be smarter than the rest. We have to be more disciplined than the rest."

Warren Buffett

Investment terms of Real Estate Private Partnership syndications are complicated. Which ones are likely to meet your investment objectives? We understand the "Math" of REPPs from the Acquisition through to the Exit and will help you learn "what you're signing up for".Independent educational and consulting services:

Partnership Selection

Performance Evaluation

Partner Tax Planning

Planners consider, trust and verify.

Less tax. More profit.

Learn More

A 401K THAT PAYS YOU

op·por·tu·ni·ty cost

"The loss of potential gain from other alternatives when one alternative is chosen."

LEXICO | Oxford Press

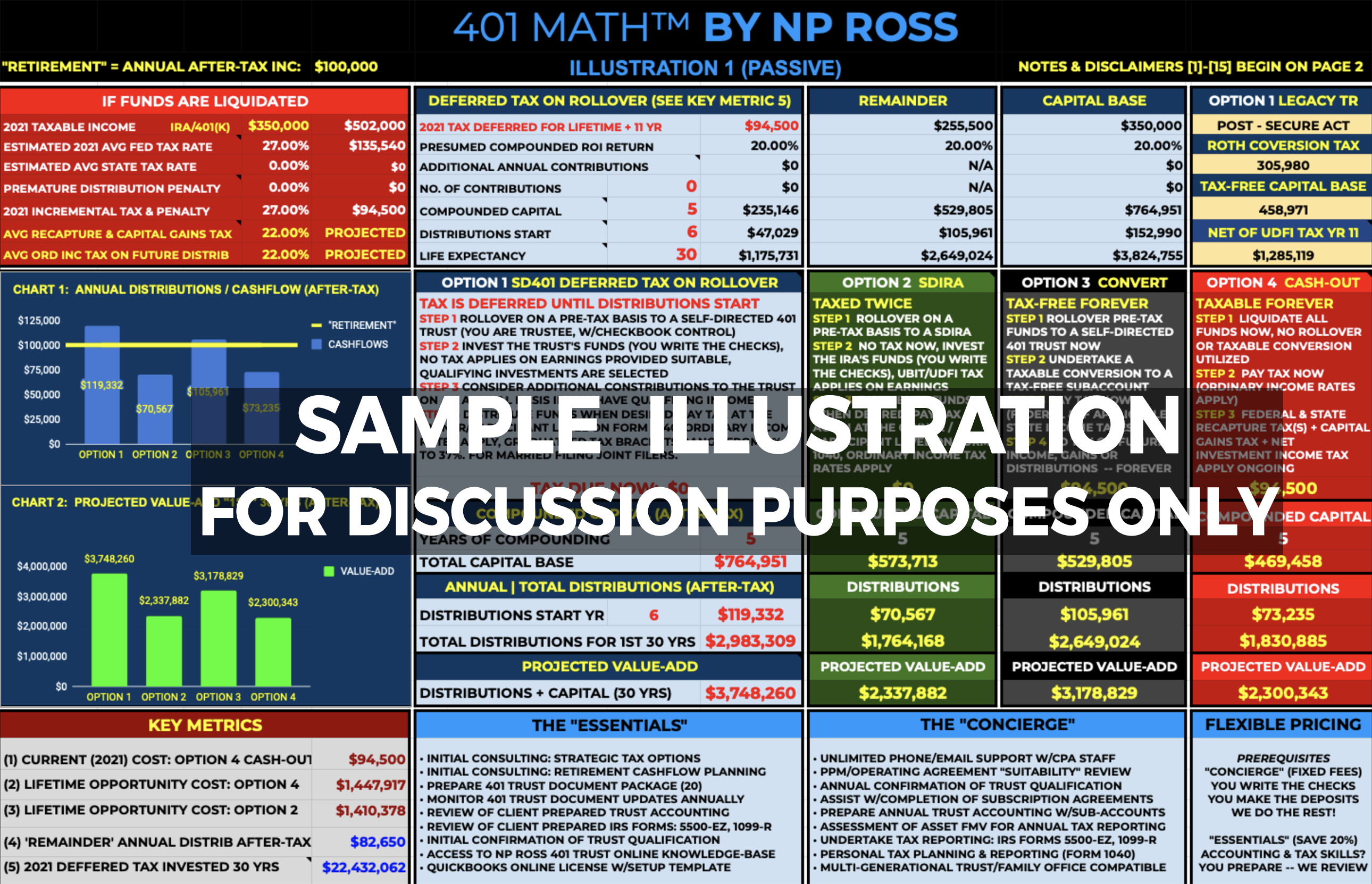

There are just three options under the Tax code that allow you to TAKE CONTROL of your current retirement funds to invest in real estate. However, only one can minimize your tax burden, double your retirement wealth, and even PAY YOU while it's doing it. Our 401 MATH™ Illustration projects when your current facts & resources are able to produce enough after-tax cashflow (the money) that defines retirement (the lifestyle).

Less tax. More profit.

"The best things in life are tax-free."

Joseph Bonkowski

PAY TAX NOWTaxable Forever

• Liquidate all tax-deferred funds now, no rollover or taxable conversion utilized

• Ordinary tax rates apply, FEDERAL + STATE + LOCAL + a 10% penalty if applicable

• Going forward, Passive Activity Loss limitation rules apply, Federal & State tax is due on net taxable income + depreciation recapture + capital gains + the Net Investment Income or, "ObamaCare" tax =

TAXABLE FOREVER

401 TRUST

DEFER TAX NOW

or CONVERT to

TAX-FREE FOREVER

or CONVERT to

TAX-FREE FOREVER

• Direct rollover from IRA 401k 403(b) 457(b) or QDRO, TAX IS DEFERRED

• Distribute funds at any time, ordinary tax rates apply + a 10% penalty if applicable; hardship exceptions available

• Loan provision up to $100k ($50k ea. spouse/participant)

• OR,

post-rollover elect to pay a Conversion tax on all or part of the Trust's funds; qualifying distributions related to converted funds =

TAX-FREE FOREVER

ROLLOVER IRA

Taxed Twice

• Direct Rollover from 401K (or QDRO account), TAX IS DEFERRED

• 1st TAX: UBIT/UDFI* ("Leverage tax") which applies to both the annual net income and any gain from using leverage =

IRA ACCT PAYS TAX

• 2ND TAX: Distribute funds at any time, ordinary income rates apply + a 10% penalty if applicable; hardship exceptions available =

IRA OWNER PAYS TAX

*Unrelated Debt-Financed Income

Learn More

We are Planners

"If you think professionals are expensive – see how much amateurs cost you."

Red Adair, Houston, TX (legendary oil well firefighter)

A Planner? Or, a Reporter?

Which type of professional do you want to work with?

One who works to reduce your tax bill by planning?

Or one who only reports it?

Less tax. More profit.

Free Offer Below