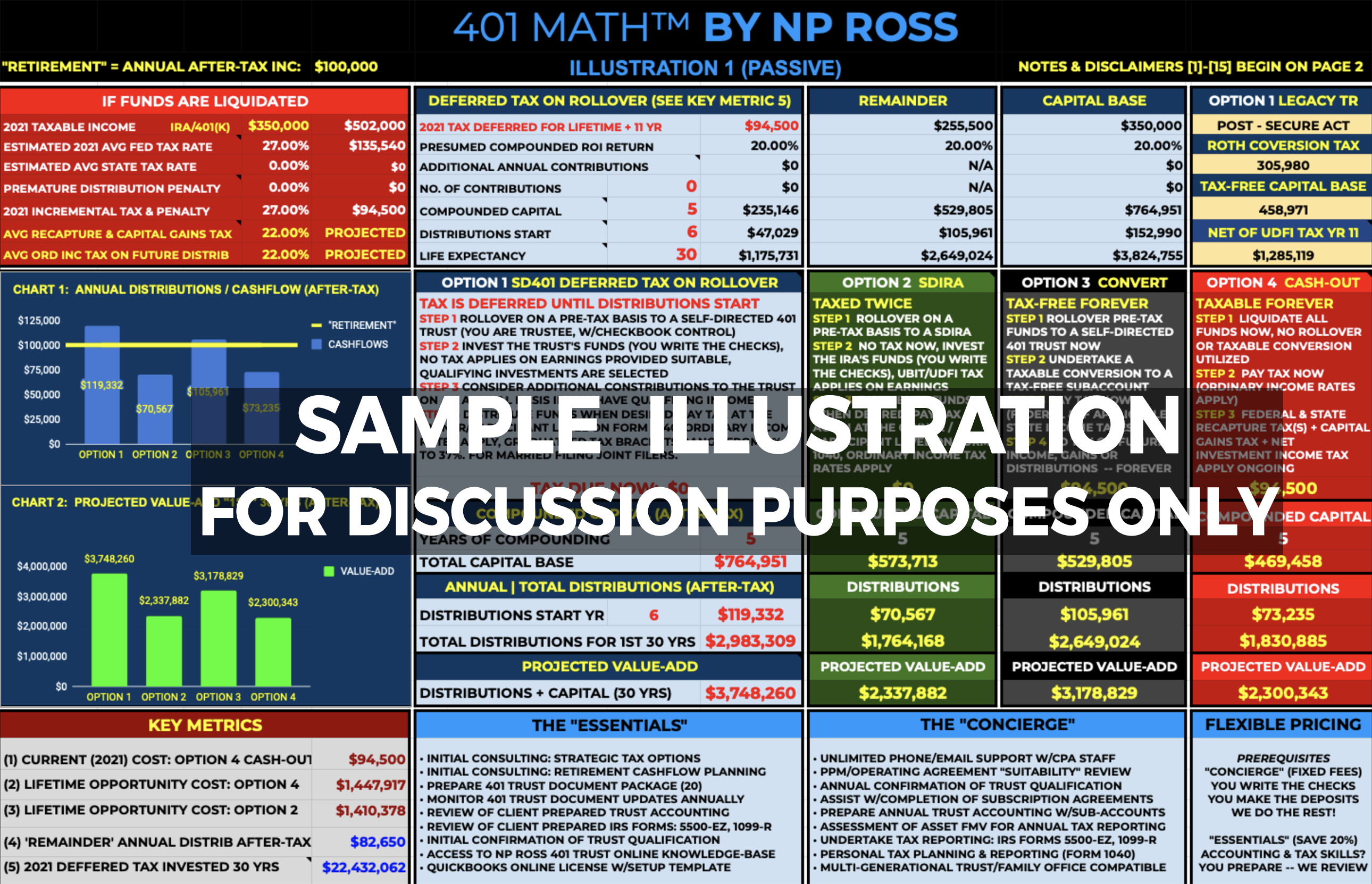

You are behind on saving for retirement, and seeking a way to turbocharge retirement savings. Most small business owners are unaware of the significant benefits of the self-directed 401 Trust. In this episode, host Nathan Ross CPA discusses the qualifications to establish a 401 Trust along with assorted reasons why it can be hugely beneficial for generating significantly more retirement savings than other options available to self-employed individuals who are also real estate investors.

- High annual contribution limits

- Exempt from UDFI tax investment gains from real estate

- Both Pre-tax 401 and Roth 401 options in the same Trust

- There are NO income limits for Roth 401

- Pre-tax 401can be converted to Roth 401

- The owner and their spouse may be eligible to participate

- Participant loans up to $50,000. per participant

- Checkbook control, you are the trustee

Join us for future weekly episodes where we discuss 401 Trusts, Roth 401 conversions, private real estate partnerships, Zero Tax Math™ strategies and more. If you have questions, learn more or connect with us.