“Tax-Leveraged” Investing

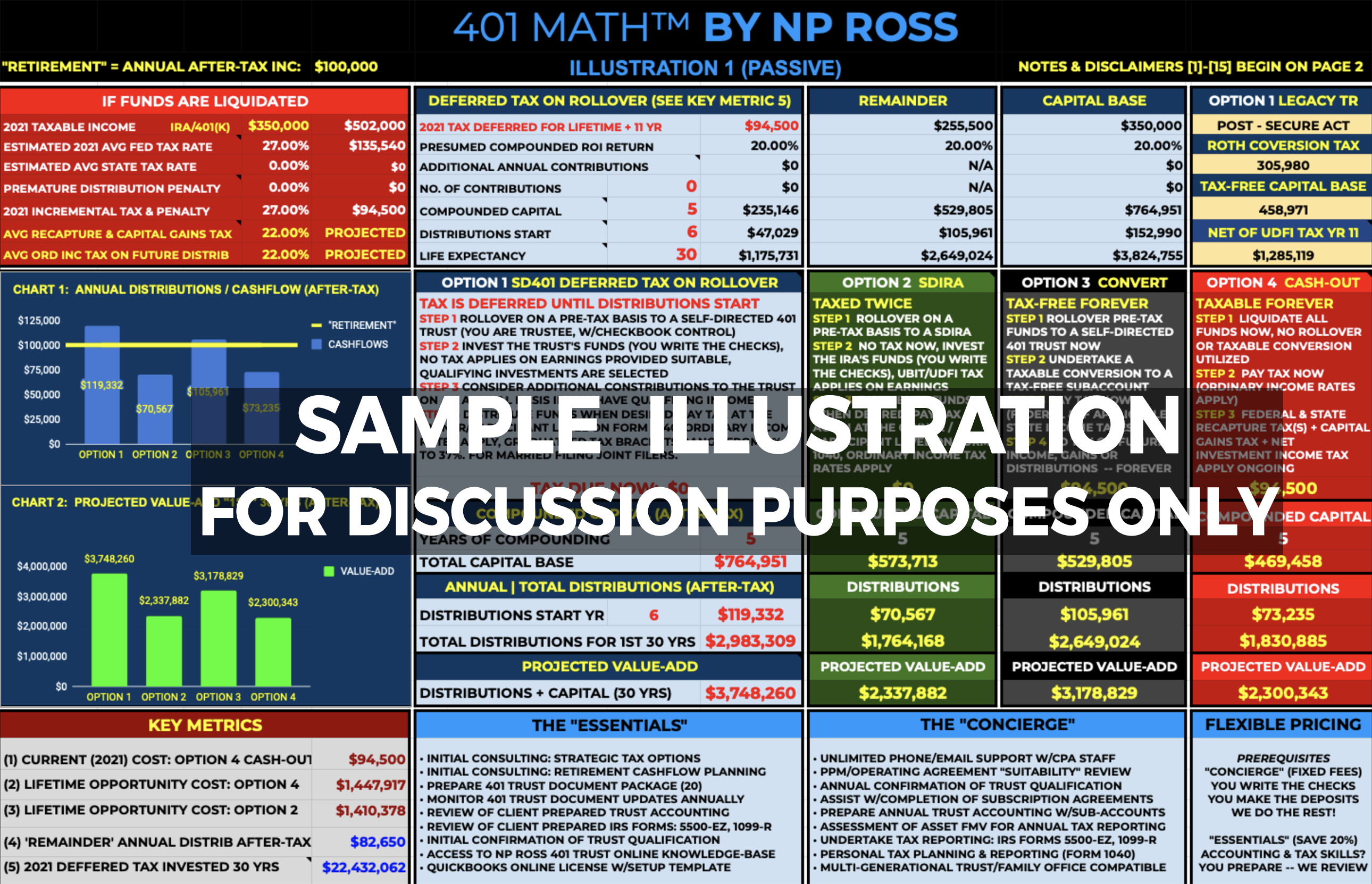

Investors come to us for customized solutions to assist them with better understanding and objectively analyzing investment opportunities as they try to achieve higher returns with their family’s financial resources. We are experts in navigating the green and red lights of the tax code, saving real estate investors and retirees millions. Tax savings are then used to leverage the purchase of additional income-producing assets which increase in value, funding the acquisition of more assets that then generate even more income. Understanding how to create, maintain, and grow wealth using tax-leveraged investing is the essence of the Be A Planner mindset.

Our tax professionals are also real estate investors that have a deep understanding of cap rates, net operating income (NOI), IRC 1031 tax-free exchanges, and debt-leveraged real estate investments. They understand how to structure, account, and report for Self-directed retirement funds invested in real estate assets in a tax-optimized fashion that provides our clients the use of 100% of their retirement capital for building the necessary wealth to achieve their chosen retirement lifestyle.

Our independent real estate tax CPAs and advisors exclusively serve investors who aspire to BE A PLANNER™ using real estate to grow wealth. We have none of the non-compete agreements or other related-party conflicts that are often found within the tangled web of radio shows, podcasts, books, mentor groups, investment platforms, real estate brokers, deal sponsors and key principals that market and promote REPPs*. Please, only make educated, objective and fully informed investment decisions, your family’s financial well-being depends on it. Never assume. ASK.

* Real Estate Private Placement