TAX OPTIMIZED REAL ESTATE INVESTING FOR EARLY RETIREMENT

Let’s get started on your early retirement.

"But getting by don't mean your living..."

Neil Diamond | "Nothing But a Heartache" (at 1:09)

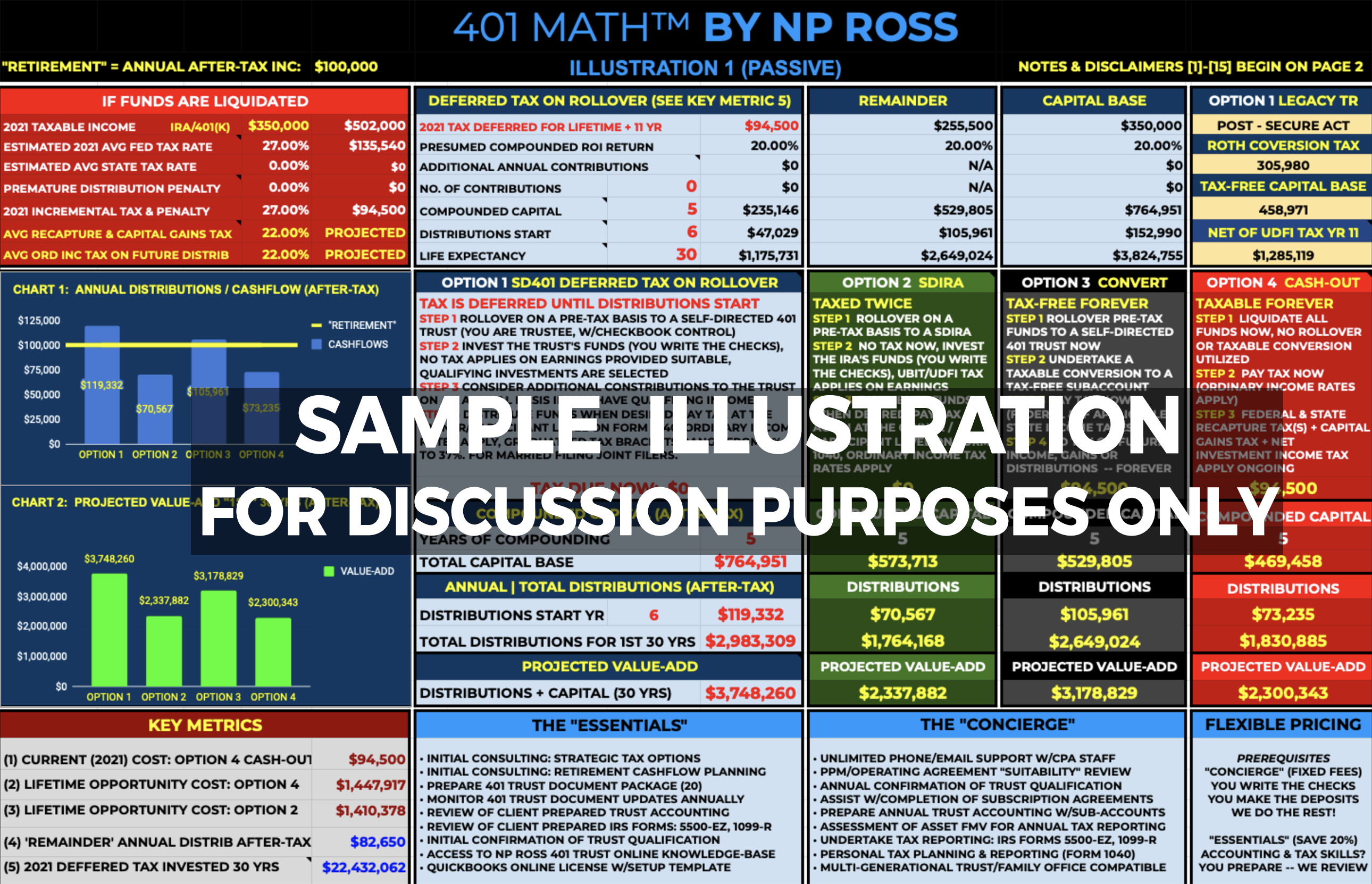

The illustration shown below is for educational purposes only, and should not be relied on for tax, legal or accounting advice. Consult your own tax, legal and accounting advisors before engaging in any transaction.

Example 1: $350,000 401K, 20% IRR, 5 Yr Compound

THE FREE OFFER:

Complete our Intake Forms to receive a custom, complimentary 401 MATH Illustration.

Less Tax. More Profit.

GET THE FORMS

NP ROSS CPAS

11200 Westheimer #150

Houston, TX 77042

info@npross.com

Complete our Intake Forms to receive a custom, complimentary 401 MATH Illustration.

Less Tax. More Profit.

GET THE FORMS

NP ROSS CPAS

11200 Westheimer #150

Houston, TX 77042

info@npross.com

Houston, TX 77042

info@npross.com