STEP 1 – CLIENT PROFILE, this form will enable us to mutually assess the likelihood that we are able to sync up with your tax and/or accounting needs and related expectations. Our being aware of the details provided by your responses will be very helpful in allowing us to determine how we might be able to add value to the standard services that you might otherwise expect from a relationship with real estate-focused tax professionals who seek to be PLANNERS, not simply REPORTERS regarding your future tax outcomes!

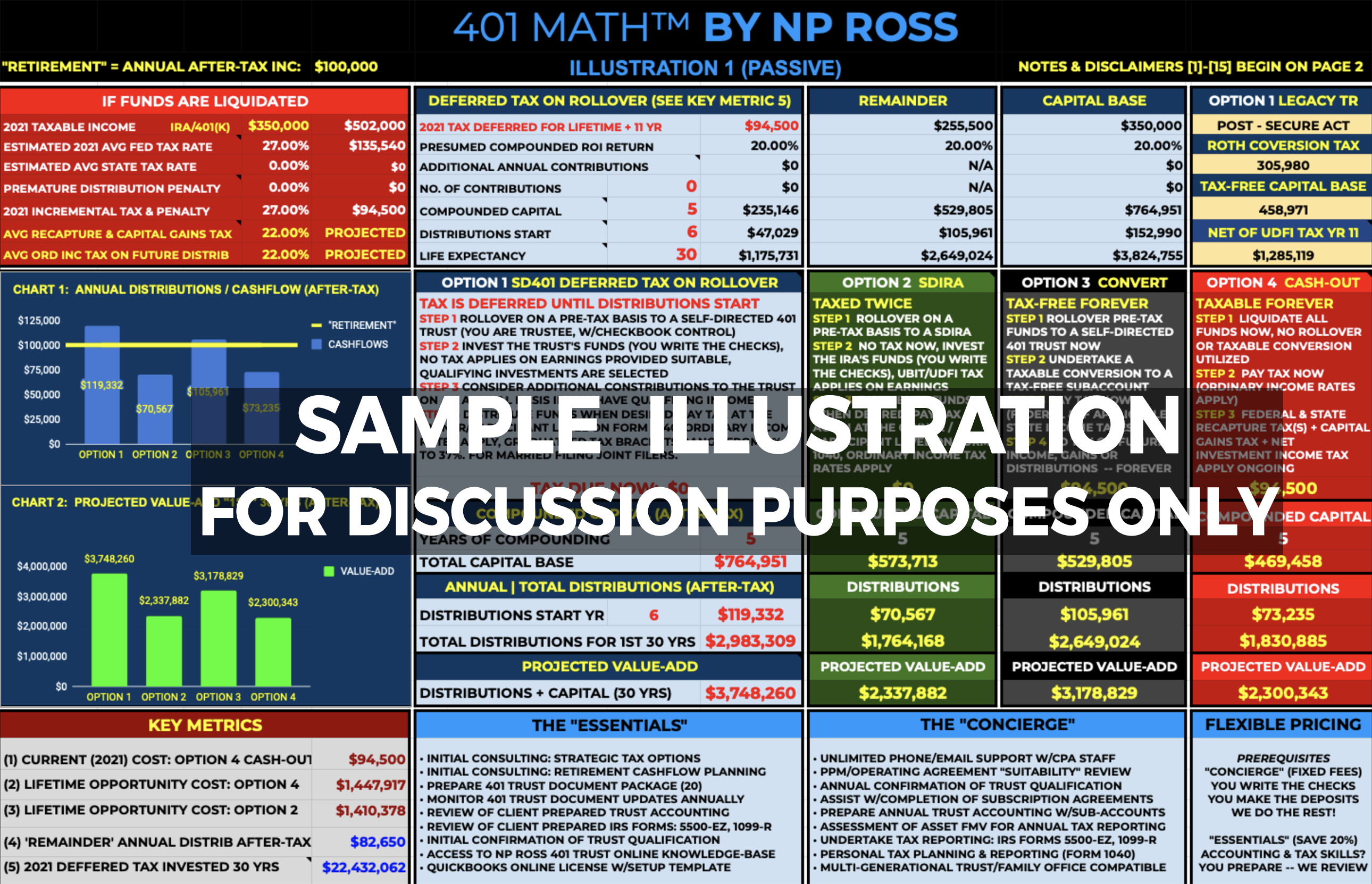

STEP 2 – RETIREMENT PROFILE, this form provides us the information to determine how we can assist your ability to grow your retirement assets tax-free whether investing in single-family and/or multi-family rental real estate. The Self-directed 401 Trust strategy we utilize gives you (1) complete control of the trust’s checkbook at all times, (2) complete decision-making control of who, what, when, where and how much Trust assets are invested, and finally (3) complete control over deciding the frequency and amounts of payments to yourself * so you are able to “retire” on your own timeline — even if you are under the age of 59 1/2** and/or perhaps NOT ready to leave your current employer.

STEP 3 – The following two forms allow us to determine the scope of the tax reporting components of any Client Service Package that we may propose once we review your form submissions.

INDIVIDUAL TAX REPORTING PROFILE

BUSINESS TAX REPORTING PROFILE (if applicable)

NOTES:

* Excluding Plan loans to yourself, payments to yourself are generally taxable at such time as you receive them and may also be subject to a 10% premature distribution penalty for those under the age of 59 1/2.

** Generally applicable for residents of the State of Texas. Check with us if you reside in another State.